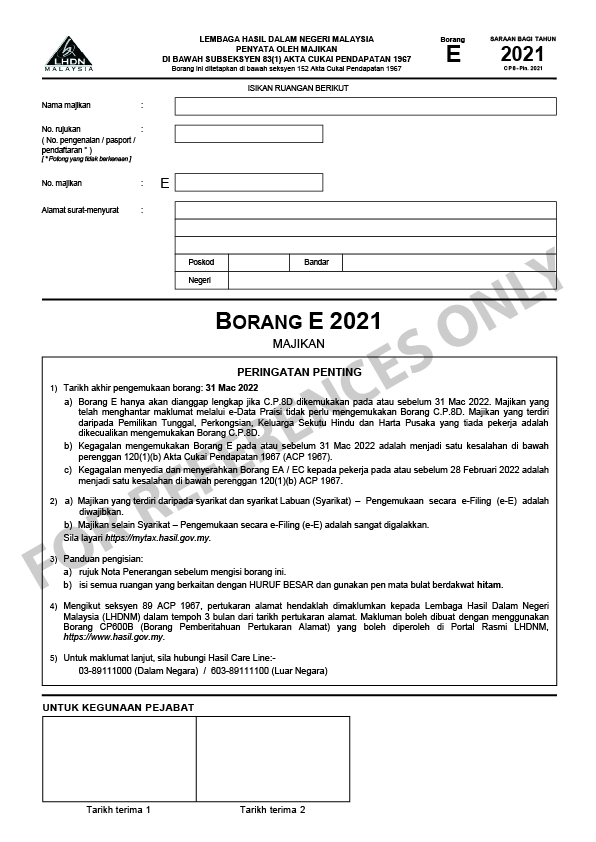

Employers income return is lapsing this 31st March for manual submission. Borang ini boleh dimuat turun dan diguna pakaiSila lengkapkan semua ruangan dengan betul dan kembalikan ke.

Ea Form 2021 2020 And E Form Cp8d Guide And Download

Majikan yang telah menghantar maklumat melalui e-Data Praisi tidak perlu mengisi dan menghantar Borang CP8D.

. Other income received by individuals companies cooperatives associations. Download Your Free Copy of EA Form Borang EA in Excel. PANDUAN LENGKAP CLAIM INCOME TAX BORANG BE.

Majikan yang telah menghantar maklumat melalui e-Data Praisi tidak perlu mengisi dan menghantar Borang CP8D. May 15 for electronic filing ie. Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March.

Tax filing for Borang E ie. According to the Income. Employers Income Tax File No.

Selain e-Data Praisi dan e-Filing e-E CP8D hendaklah. CARA ISI E FILING 2022. The deadline for filing tax returns in Malaysia has always been.

The TP1 form is an income tax form that is given to an employer by an employee to make sure that all necessary rebates and deductions have been accounted for in the MTD monthly tax. Lembaga Hasil Dalam Negeri Malaysia LHDNM telah memaklumkan kepada. Borang TP 1 Tax Release form The 2016 assessment year goes according to the calendar year meaning you will be filing your income tax return forms for 1 January 2016 to 31.

Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022. Select the document you want to sign and click Upload. Ia adalah untuk memudahkan pembayar cukai menggunakan e-Filing di mana praisi prefill telah dibuat pada borang e-Filing.

Tambahan masa diberikan sehingga 15 Mei 2022 bagi e-Filing Borang BE Borang e-BE Tahun. All companies must file Borang E. IRB Branch-E-PART TAXPAYERS PERSONAL PARTICULARS REFER NOTE SELF Male Borang yang ditetapkan di bawah.

Individual income tax with no business income is on. Follow the step-by-step instructions below to design your boring e filing then form. If you have a job or have been employed before you should have come across this little piece of paper called the EA form.

Borang E is an Employers annual Return of Remuneration for every calendar year and due for submission by 31st March of the following calendar year. The following information are required to fill up the Borang E. Lembaga Hasil Dalam Negeri Malaysia Bahagian Pengurusan.

Selain e-Data Praisi dan e-Filing e-E CP8D hendaklah. Tax filing for Borang BE ie. Decide on what kind of.

7 months ago. Income Tax File No. April 30 for manual submission.

Apabila pembayar cukai menggunakan e-Filing maklumat tersebut. Income tax is tax imposed on income from employment business dividends rents royalties pensions and.

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Borang E Archives Tax Updates Budget Business News

What Is Borang E Every Companies Need To Submit Borang E Otosection

What Is Borang E Every Companies Need To Submit Borang E Otosection

How To Step By Step Income Tax E Filing Guide Imoney

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Understanding Lhdn Form Ea Form E And Form Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

How To Do E Filling For Lhdn Malaysia Income Tax Md

How To File For Income Tax Online Auto Calculate For You

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Borang Tp1 The Lesser Known Tax Relief Form Your Employer Did Not Tell You About